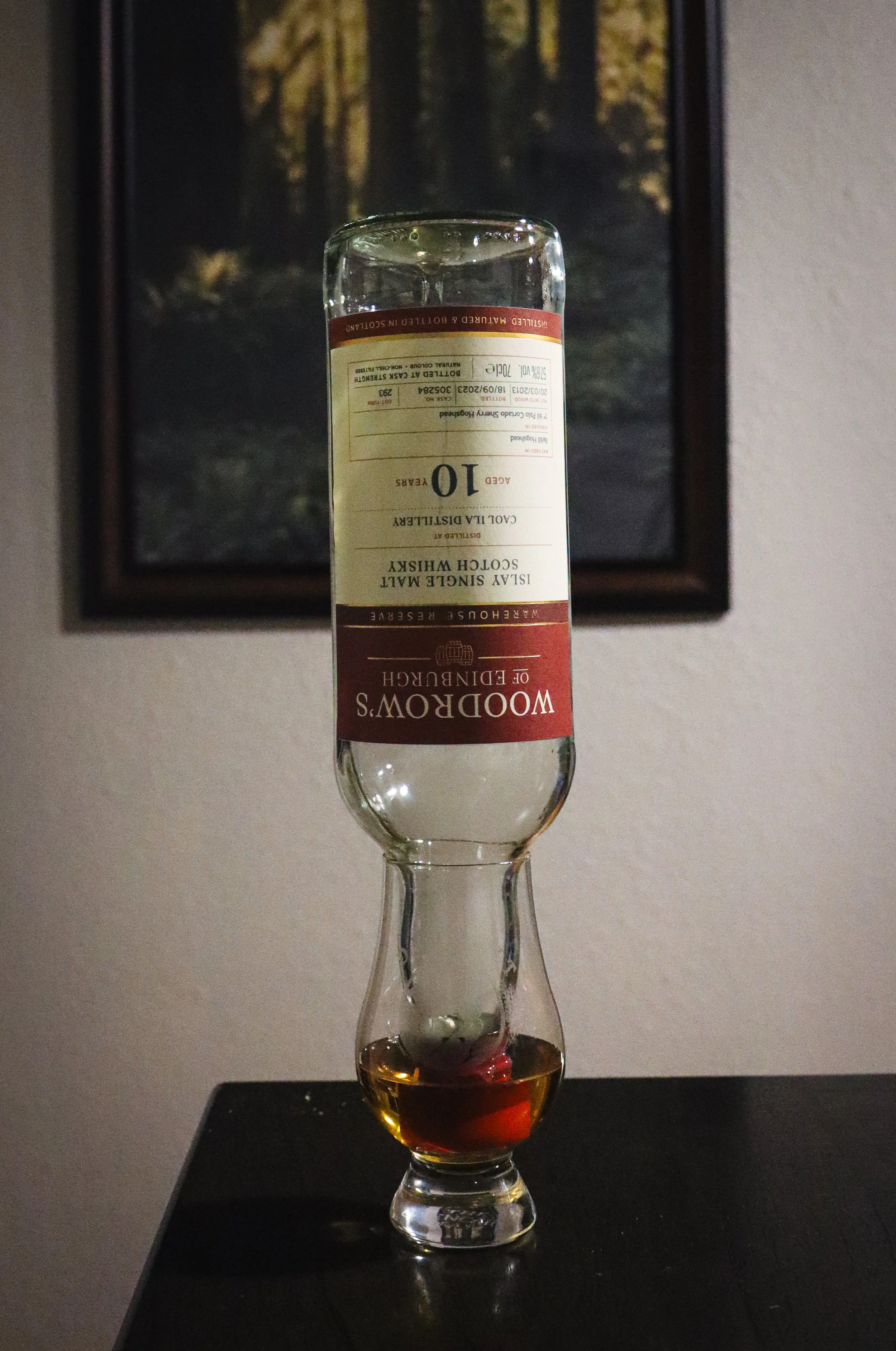

Ardbeg BizzarreBQ

Official Release | 50.9% ABV

Score: 7/10

Very Good Indeed.

TL;DR

Another Ardbeg sherry cask success story

A break in the perfunctory chain?

I hear you muttering upon reading this article’s title: “Another one?” Surely these Ardbeg reviews must be little more than perfunctory trend-following, yes? In a sense, yes indeed. More of the same for this gimmicky, forced and otherwise uninspired marketing ploy? Actually, no.

The greatest complaint that can be levelled against the vast majority of Ardbeg’s limited releases from the last three years or so, is the pricing. The second greatest is the notable immaturity of many of those releases especially given the price.

I say immaturity and the whiskies have appeared young, but I also mean there’s been very little cask influence. This could be explained by any of several motivations. The more cynical might suggest it’s a means of selling whisky matured in tired casks that otherwise might have needed replacing, thus saving money on oak.

I’d like to address this theory with a quick aside. Say we consider an American oak hogshead has previously matured bourbon once - a safe assumption given the USA’s current laws, and scotch malt whisky twice, say around 10 years per malt. From the accounting standpoint of many companies, that cask has paid itself off, unless more money is invested to refurbish the cask for further use, at which point it must then pay itself off for the refurbishment. Any future use without refurbishment could be considered profit without investment.

This sort of thing is occasionally done by distilleries that have a spirit which has achieved sufficient extractive maturation from other casks but needs time to reach its full potential - or vice versa - via re-racking. Generally though, those casks require a significant amount of time to achieve the desired maturity and so become long term investments - not exactly ideal for a publicly listed company trying to boost revenue in the short-term.

Say you have a hot marketing department that can spin a tale or two about extraneous nonsense well enough to move bottles of that young, under-extracted spirit that has cost very little to make, both due to the oak and young age. Let’s compare the costs involved with using that cask (which the bean counters consider free) vs. a fresher, more premium cask with greater extractive potential.

Once again, we’ll rely on the approximation style of Enrico Fermi. The figures we get out of this will thus be little more than an order of magnitude level of accuracy, but that should still demonstrate the point well enough. Aside within an aside, how good was Oppenheimer? Thrilled Fermi got a few brief features. Right, here we go.

If we go very high and assume that a new, premium hogshead holding about 250L (virgin oak with custom coopering, ex-oloroso, Bordeaux red wine etc) is about £1000 for a distillery to acquire, then let’s see how much that cost filters down into the cost of a bottle of whisky. Assuming the distillate is filled into cask at the standard 63.5% ABV, then the angel’s share can be approximated (upper bound) at around 2% volume per year.

The ABV decrease can similarly be approximated at around 0.5% reduction per year, though this and the angel’s share volume are both dependent on many factors. If we assume that the whisky is released at around 10 years old (a generous estimate given some of the more recent bottlings) then we can compound these rates to determine the number of bottles each cask will disgorge. After ten years, allowing up to another 10 litres irretrievably absorbed into the cask’s staves, there should be about 194 litres or more at 60.4% ABV. Dividing this by the ratio of ABVs between cask exit strength and bottling strength (in this case, 50.9/60.4) and dividing by bottle volume (0.7 litres) yields around 329 bottles or more per cask. That means the cost price of producing a bottle increases by a little over £3 according to my approximation.

Naturally, after the whisky has been disgorged, the distillery can still use this cask at least another one or two times as a refill so the economy of use actually brings the total difference of cost between cask types even lower. Keep that in mind the next time a distillery tries to justify the expense of their bottles on the basis of cask costs alone.

So what other reasons might the distillery have for using less active casks? As any scientist can tell you, when designing an experiment to test a hypothesis one should control as many of the non-dependent variables as possible. That means for something like the Ardcore, Hypernova or Heavy Vapours releases, which are all dependent on spirit-derived variations, minimising the flavour variation and spirit character occlusion due to cask influence as much as possible.

Functionally, this means releasing the whiskies on the younger side and with less perceivable cask extract per unit time. Dr. Bill Lumsden is very much a scientist at heart, something evidenced by LVMH’s construction of the Lighthouse distillery for innovation under the Glenmorangie banner.

Another explanation is that the whiskies were originally slated for a longer maturation before release, but mitigating factors have caused their early releases. Such factors could be that the distillate flavours had begun to fade more quickly than anticipated, that other experimental designs weren’t developing quickly enough to follow original scheduling or that there were other, less transparent internal mechanisms motivating certain releases at given times.

Whatever the reasoning, Ardbeg has certainly taken a series of knocks in reputation from the recent special releases. Anyone blindly continuing to buy multiple bottles of each new release is either an ideologically die-hard and cultist fan of the distillery, a collector with little to no care for the bottles’ contents, or has nefarious (read as flipping) intentions for the bottles down the track.

So with all of that said, what is this release like?

Review

Ardbeg Bizzarrebq, Official release, 50.9% ABV

AUS$145 (£75) paid

I’m sure we’ve all read the marketing stats for this release, but let’s go over them anyway.

The USP suggestion is a proportion of the casks were treated with BBQ smoke prior to filling with new-make or whisky. Whether that occurred at the point of filling with new-make, or as a finishing technique at the end of maturation is unclear. I presume the impact would be greatest when used as a finishing process, though the effect might not achieve proper integration with the spirit at this stage. In any case, I can only speculate.

The marketing department has also been pretty cagey about what exactly this BBQ treatment was. Feel free to take a look at the fully tongue-in-cheek silliness of this advert released to YouTube to see what I mean. The marketing materials do give some information though. The wording is slightly open to interpretation but it feels safe to assume all three cask types (double-charred, PX and “BBQ”) were toasted at some stage.

Double-charred could mean any number of things, but I’d guess they’re probably re-coopered ex-bourbon casks that have been rejuvenated after multiple uses by de-charring, toasting and then re-charring prior to use for this release.

PX makes sense, since the majority of wine/fortified casks are toasted as part of the coopering assembly process. Presumably the BBQ casks were either toasted using some “BBQ” materials, or the whole barrel interior was “BBQ” smoked after the re-charring process.

Regardless, one thing has been made clear - for the first time since arguably the Scorch release, we have a special release with a fair degree of cask extract. The only questions remaining are what has been extracted, whether or not those extracts are well balanced overall and whether they have properly integrated with the Ardbeg spirit.

Score: 7/10

Very Good Indeed.

TL;DR

Another Ardbeg sherry cask success story

Nose

Promising. There’s still Ardbeg DNA on abundant display with some medicinal phenolics, firm lemon-pepper terpenes, coastal bromophenols and abundant smoke. There’s a bit of an amplified bonfire quality too, as well as a moderate menthol/eucalyptus note, the pair being somewhat redolent of Australian bushfire plus liquid smoke.

The sherry casks are also felt moderately with some slight bacon meatiness (possibly the “BBQ” casks?) plus subtle mocha and mixed baking spices.

Palate

Much of the same. The terpenes are popping more here than the nose which, along with the medicinal cresols, gives a nice fresh lift to the more savoury/smoky components. The bushfire vibe continues along with hot coals, some soft mezcal tones and BBQ char, meanwhile the sherry element adds a good bacon-esque meatiness to the whole; bonus marks for a clean sherry influence too. Some nice cask lactones and youthful malt give a perceived sweetness that help to counterbalance the peat.

It’s not the most earth shatteringly complex palate, but what’s there is working very well, the cask influence working synergistically with some of the fresher elements of presumably the younger spirit.

The Dregs

To establish a baseline, I poured comparative drams from my bottles of Ardbeg Uigeadail, Wee Beastie and 8 year old For Discussion. The sherry influence here feels softer than the first two and perhaps on par with the latter. That said, it was a stark reminder of the sulphur issues the Wee Beastie suffers from - a bottle I won’t be replacing without significant QC improvements.

Does this whisky fully merit the price tag? It’s really quite hard to say in today’s market. A year ago, I’d probably have said not quite. This year, with the meteoric increases across the board, particularly in the hype and premiumised sub-categories I think this is well on par, so I’m not detracting a point for scoring.

Speaking of which, I wavered about scoring for a while but in the end decided it deserved to be rounded up more so than rounded down. I still prefer both the 8yo and 10yo releases and their pricing continues to represent fantastic value; long may it last.

All in all, I’m glad to have bought this bottle, and even were I not to share it with my whisky club, I wouldn’t regret the purchase. Of course, it’s still quite gimmicky and the lack of transparency in production is a shame, but the liquid is tasty. At the end of the day that’s what should principally concern us and never more so considering the prices we’re being asked to pay.

Perhaps there’s hope yet for the committee release series? Time will tell.

Score: 7/10

Tried this? Share your thoughts in the comments below. TK

-

Dramface is free.

Its fierce independence and community-focused content is funded by that same community. We don’t do ads, sponsorships or paid-for content. If you like what we do you can support us by becoming a Dramface member for the price of a magazine.

However, if you’ve found a particular article valuable, you also have the option to make a direct donation to the writer, here: buy me a dram - you’d make their day. Thank you.

For more on Dramface and our funding read our about page here.